Historically speaking, oil and natural gas have been used as a means to try and affect political change. These strategies do not always work and unpleasant consequences surface from the attempt. Let’s look at three examples of the use of oil and gas to drive political change.

1970’s OPEC Oil Embargo/Iranian Revolution

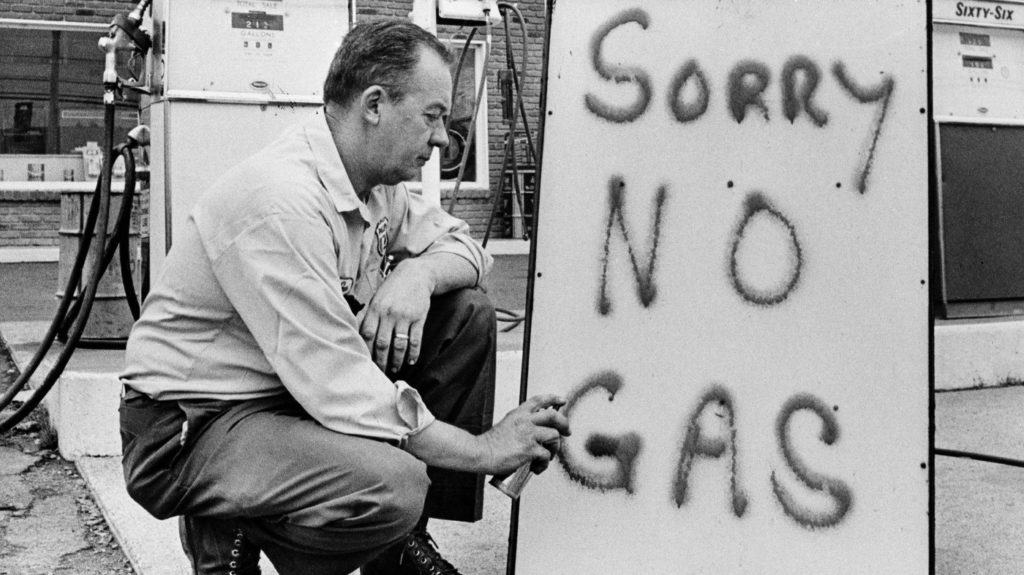

Beginning in 1973, in retaliation to the United States supplying the Israeli military during the Arab-Israeli War, Arab members of the Organization of Petroleum Exporting Countries (OPEC) imposed an embargo of petroleum exports to the U.S.1U.S. Department of State. (n.d.). Oil Embargo, 1973–1974. U.S. Department of State. Retrieved October 4, 2021, from https://history.state.gov/milestones/1969-1976/oil-embargo. Given the Shale Revolution had not occurred yet at this time, suddenly the United States did not have enough oil to refine into gasoline. As a result, oil prices spiked, there was a national gas shortage, and the Nixon Administration called on domestic oil production to fix the consequences of the embargo. The shortage and spike in gasoline prices as a result of the 1973 Oil Embargo was later recognized as the “first oil shock.”2Wikimedia Foundation. (2021, October 3). 1973 oil crisis. Wikipedia. Retrieved October 4, 2021, from https://en.wikipedia.org/wiki/1973_oil_crisis. Additionally, the United States’ efforts to create peace between Israel and Saudi Arabia were not successful. As a result, the embargo came to a halt in 1974, but the impacts were felt for several more years.

Furthermore, there was an overthrow of the Shah of Iran, a major United States ally, led by Mohammed Reza Shah Pahlavi, and a new government formed to create the Islamic Republic. The Islamic Republic was recognized as an enemy of Iran, focused on being a fundamental Islamic state, versus the “Western” orientation of the Shah and his government. As a result of the revolution, strikes began in the oil fields of Iran that led to significant decline in production, with supply shortages close to 5 million barrels of oil daily, recognized as the second oil shock. While other global producers were able to ramp up production, there was still a significant decline in the world’s supply which led to considerable price spikes globally.3Gross, S. (2019, March 5). What Iran’s 1979 revolution meant for US and Global Oil Markets. Brookings. Retrieved October 4, 2021, from https://www.brookings.edu/blog/order-from-chaos/2019/03/05/what-irans-1979-revolution-meant-for-us-and-global-oil-markets/.

U.S. Sanctions Against Iran

Historically the United States has imposed sanctions on countries, such as Iran, in an effort to influence political change. By definition, a sanction is a “threatened penalty for disobeying a law or rule.” The United States first began imposing sanctions on Iran over forty years ago, beginning in 1979, due to seizure of the American embassy in Tehran during the Iranian Revolution. For an entertaining history-based story, watch Ben Affleck’s movie Argo about how the United States staged a fake sci-fi movie to get some of these American hostages out of Iran.

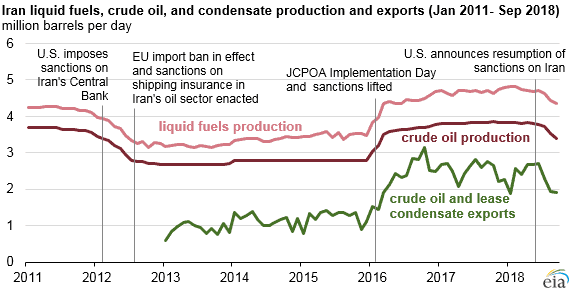

More recently, in 2007, the United Nations adopted a resolution to tighten sanctions because Iran would not follow UN orders to halt its uranium enrichment program. U.S. sanctions targeted Iran’s petroleum industry when the U.S. Congress adopted the Comprehensive Iran Sanctions, Accountability, and Divestment Act in 2010. These sanctions targeted firms investing in Iran’s energy sector or selling refined petroleum to Iran, and foreign banks doing business with designated Iranian banks. By curtailing Iran’s oil revenue the United States stepped up pressure to establish nuclear nonproliferation.4Wikimedia Foundation. (2021, September 29). Sanctions against Iran. Wikipedia. Retrieved October 4, 2021, from https://en.wikipedia.org/wiki/Sanctions_against_Iran.5A brief history of sanctions on Iran. Atlantic Council. (2018, May 8). Retrieved October 4, 2021, from https://www.atlanticcouncil.org/blogs/new-atlanticist/a-brief-history-of-sanctions-on-iran/.

For example, the chart below illustrates that Iran’s crude oil exports and production significantly declined as a result of the May 2018 announcement that the United States would withdraw from the Joint Comprehensive Plan of Action (JCPOA) and reinstate sanctions against Iran. The JCPOA was a 2015 agreement with Iran and several other countries including the United States where relief of sanctions would take place if Iran adhered to restrictions regarding their nuclear program.6Council on Foreign Relations. (n.d.). What is the Iran Nuclear Deal? Council on Foreign Relations. Retrieved October 4, 2021, from https://www.cfr.org/backgrounder/what-iran-nuclear-deal.

U.S. Sanctions Against Venezuela

For over a decade, the United States government has imposed sanctions against Venezuelan individuals linked to criminal activities such as terrorism and drug trafficking. Following Venezuelan President Nicolás Maduro’s rise to power in 2013, U.S. sanctions have evolved to address the continuing deterioration of democracy and human rights in the country. The U.S. government considers Maduro’s presidency to be illegitimate, and his regime is marked by authoritarianism, intolerance for dissent, and violent and systematic repression of human rights and fundamental freedoms.7U.S. Department of State. (2021, July 6). U.S. relations with Venezuela – United States Department of State. U.S. Department of State. Retrieved October 4, 2021, from https://www.state.gov/u-s-relations-with-venezuela/. U.S. sanctions are designed to limit profits Maduro’s government can take from illegal gold mining, state-operated oil activities, or other business transactions to enable the regime’s criminal activity and human rights abuses.8N. K., By, & Kirschner, N. (2021, February 10). U.S. sanctions on Venezuela explained. ShareAmerica. Retrieved October 4, 2021, from https://share.america.gov/u-s-sanctions-venezuela-explained/. These sanctions have crippled the country’s most important industry: oil export revenue collapsed from $4.826 billion in 2018 to only $477 million in 2020.9Bartlett, J. & M. Ophel. (n.d.). Sanctions by the numbers: Spotlight on Venezuela. Center for a New American Security (en-US). Retrieved October 4, 2021, from https://www.cnas.org/publications/reports/sanctions-by-the-numbers-3.

Previous economic issues in Venezuela, coupled with international sanctions and the coronavirus pandemic, have fueled a devastating humanitarian crisis, with severe shortages of basic goods such as food, drinking water, gasoline, and medical supplies.10Council on Foreign Relations. (n.d.). Venezuela: The rise and fall of a petrostate. Council on Foreign Relations. Retrieved October 4, 2021, from https://www.cfr.org/backgrounder/venezuela-crisis. Since 2017, the United States has provided more than $1.4 billion in humanitarian assistance along with $272 million in economic development, and health assistance to support the response to the crisis inside Venezuela and throughout the region.11U.S. Department of State. (2021, July 6). U.S. relations with Venezuela – United States Department of State. U.S. Department of State. Retrieved October 4, 2021, from https://www.state.gov/u-s-relations-with-venezuela/. But the crisis continues, with some estimates placing 96 percent of Venezuelans living in poverty.12Al Jazeera. (2020, July 8). ‘there is no wealth to distribute’: Venezuela poverty rate surges. Poverty and Development, Al Jazeera. Retrieved October 4, 2021, from https://www.aljazeera.com/economy/2020/7/8/there-is-no-wealth-to-distribute-venezuela-poverty-rate-surges.

Additional Effects from Sanctions

While these sanctions were put in place to spark political change, there are also economic impacts to consider. For example, the result of U.S. sanctions on the Iran petroleum industry is a dramatic decrease in petroleum exports, and thus revenue. If sanctions are removed and Iran can put their crude on the market at pre-sanction levels, oil prices could fall exponentially with increased global oil supply.13Congressional Research Service. (2020, February 5). Oil market effects from U.S. economic sanctions: Iran, Russia, Venezuela. EveryCRSReport.com. Retrieved October 4, 2021, from https://www.everycrsreport.com/reports/R46213.html. Additionally, U.S. sanctions against oil and gas from Venezuela have caused Venezuela to provide their oil to other buyers including China and have led to closer ties with countries other than the United States (a traditional ally of Venezuela).14Congressional Research Service. (2020, February 5). Oil market effects from U.S. economic sanctions: Iran, Russia, Venezuela. EveryCRSReport.com. Retrieved October 4, 2021, from https://www.everycrsreport.com/reports/R46213.html. Therefore, sanctions for political gain, such as the sanctions imposed on both Iran and Venezuela serve as an important example of how global political tensions can significantly impact oil and gas economics.

Image Credits

- Sorry No Gas: National Public Radio

- Sanctions Against Venezuelan Oil: Shutterstock